Datacom Challenges

This excerpt from MRSI Systems featured article in Laser Focus World highlights the photonics industry challenges of data center applications and how the photonics industry can respond:

As data center demand becomes the new growth engine, the photonics industry feels the challenges from servicing new data center business models that are far different from the traditional telecom models. The table summarizes the key differences between the telecom- and data center-centric business models. The most critical factors that impact photonics manufacturing are high volume, low forecast visibility, fast pace of innovation, quick response, and low cost.

Historically, the photonics industry has been strongly influenced by telecom that has vast field deployments. Because of the difficult operating environment (for example, -40˚ to 85˚C, RH up to 85%) and thus high cost of system deployment and maintenance, each telecom upgrade cycle is long and carefully planned. The annual forecast visibility from carriers to equipment providers and to component suppliers is fairly good. Sophisticated and expensive photonic components can be accepted during this long cycle. Photonics manufacturers have more time to plan and respond to customer demands, and the unit volume has not been as high as we have seen recently from data center business.

Data center businesses operate the majority of their networks inside of a controlled environment, for example, in temperature- and humidity-controlled buildings (for example, 0˚–55˚C, RH 40–60%). Most of the capital expenditure (capex) is on land, buildings, and cabling. A large portion of operating expense (opex) goes to energy consumption and environmental control. Photonic components are a relatively small part of capex and opex—however, they are a significant contributor to revenue generation through bandwidth sales to cloud customers.

In an office-type of controlled environment, upgrading becomes less expensive. The combination of low replacement cost and low percentage of photonic components in total capex and opex costs makes it possible for data center providers to have an upgrade cycle of three to five years for existing data centers. For each upgrade, they would like to use the most advanced photonics technologies that provide the most possible bandwidth at the time to maximize revenue out of the same building.

It is difficult for a data center provider to predict exactly when a specific data center project will start because a new data center construction project starts with a land survey and acquisition, including approvals from local governments. This significantly reduces forecast visibility to photonic component suppliers. On the other hand, once the project is approved, the data center provider will naturally want to build fast and ramp the revenue stream quickly. After a typical two to three years of construction, the new data center will be ready to go with the most advanced photonics equipment installed that could generate the maximum potential of revenue on day one.

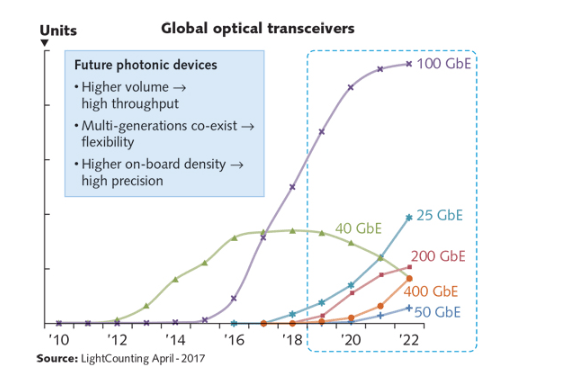

Finally, fast-paced innovations bring the double challenge of high mix and high volume to photonics manufacturing for data center applications. The 40G transceiver upgrade from 10G was the main activity in the past few years (see Fig. 2). Now, 100G is overtaking 40G as the leading technology in new volume deployment. At the same time, 200/400G solutions are at prototyping and low-volume stages. All these different technologies and products will need to coexist for a period of time and will have to pass through the same photonics manufacturing floor.

FIGURE 2. The high-volume and high-mix nature of photonics manufacturing driven by fast pace of innovations and co-existence of multiple-generation products is shown.

Opportunities and Solutions

All of these challenges driven by the new cloud-based data center business model come with opportunities. How can the photonics industry respond to these challenges? The key to addressing these challenges is automation.

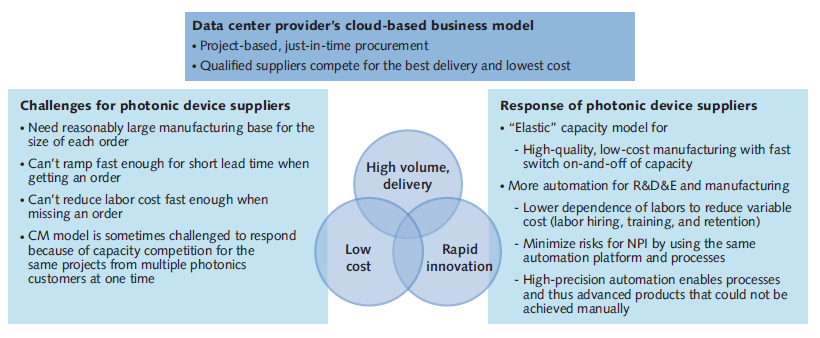

Photonic device suppliers really need to adopt an elastic capacity model that can deliver high-volume, high-quality, low-cost manufacturing with a very fast switch-on-and-off capacity for data centers’ just-in-time model that includes a low forecast visibility (see Fig. 3). Automation can ramp volume fast without worrying about the massive training needed for high-volume manual production. Automation can also lower the dependence on labor to reduce the variable costs, particularly during downtime. In addition, automation minimizes risks for a new product introduction (NPI) because manufacturers can use the same automation platform and process between development and manufacturing phases. Furthermore, high-precision automation enables processes to make advanced products that cannot be made manually.

FIGURE 3. The challenges of data center business and the potential response of photonics manufacturing are shown.

The biggest challenge now facing photonics manufacturing is how to handle the high-volume and high-mix production. The high mix of products typically originates from NPI, or from changeovers between the different products, which makes it difficult to achieve high volume in production because you cannot ramp up production as the configurations keep changing.

Solving this problem requires flexible, high-speed automation. Historically, it has been challenging to put flexibility and high speed together for automatic equipment. A case study will show it is possible to achieve high speed without sacrificing flexibility through innovation in the automation industry.

Contact MRSI Systems today to learn about our solutions for photonics manufacturing.